property tax forgiveness pa

The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district. The rebate program also receives funding from slots gaming.

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

CALCULATION OF TAX FORGIVENESS DEFINITION OF ELIGIBILITY INCOME Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal income tax return.

. Property tax reduction will be through a homestead or farmstead exclusion. To qualify for this program you need to fulfill some requirements. Subtract Line 13 from 12.

The level of tax forgiveness is based on the income of the taxpayer and the number of dependents the taxpayer is able to claim. First figure out your eligibility income by completing a PA-40 Schedule SP. Complete Tax Forgiveness Eligibility income starts with taxable income The eligibility income limit for 100.

Since the programs 1971 inception older and disabled adults have received more than 71 billion in property tax and rent relief. Property Tax Penalty Forgiveness. PA Property Tax Relief for SeniorsProperty TaxRent Rebate Program.

Then move across the row to find your eligibility income. The penalty for real estate taxes was forgiven through November 30 2020. It is designed to help individuals with a low income who didnt withhold taxes throughout the year and those who are retired.

Tax relief can be a big help because it can reduce or even completely negate the taxes you owe. The Property Tax and Rent Rebate Program would be expanded. In Part D calculate the amount of your Tax Forgiveness.

This section cited in 43 Pa. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. Not only do you include the income you report on your PA-40 but you also include but are not taxed on the.

The applicant will need to be the owner of the real estate property according to the assessors records. Effect an 85 billion elimination in homestead school property taxes by raising the personal income tax from 307 to 482 and the sales tax from 6 to 7. A The Commission will review cases that have been granted real property tax relief under the PA.

Below is a summary of how Pennsylvania tax sales work but tax. If you are filing as Married use Table 2. Ra-retxpagov Please do not send completed applications or personally identifiable.

Code 524 relating to processing applications. If you rent a property your. Insurance proceeds and inheritances- Include the total proceeds received from life or other insurance policies also include inherited cash or the value of property received.

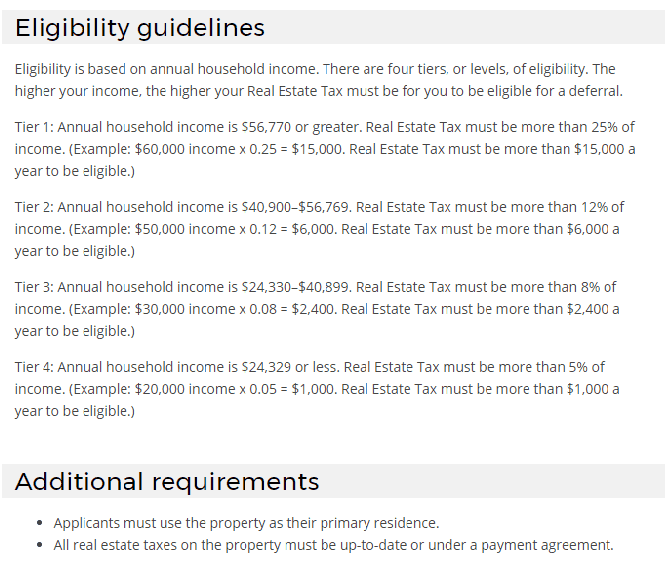

The County Board for the Assessment and Revision of Taxes will grant the tax exemption. WTAJ Older Pennsylvanians and Pennsylvanians that have disabilities are now eligible to apply for rebates on their property taxes or. Your eligibility income is different from your taxable income.

135 of home value. VIII 2c at 2-year intervals. Move down the left-hand side of the table until you come to the number of dependent children you may claim.

On 1 March 2021 during the Fiscal Strategy Debate the Most Honourable Dr. Record tax paid to other states or countries. If none leave blank.

Of course the homeowner must have been delinquent on paying their property taxes and it usually needs to be a recent issue and hardship that the person is facing. Verifying your eligibility for Tax Forgiveness based on income tables and what forms to fill out if you qualify. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify.

If you own your home your annual income cannot be more than 35000. PA Schedule SP Eligibility Income Tables. Taxes paid in December will now be assessed the penalty amount and those taxes must be paid by December 31 2020.

About The Taxpayer Relief Act. Mean for school districts 61 Pa. Provides a reduction in tax liability and.

Up to 25 cash back All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes. B On the second anniversary of the granting of real property tax relief under the PA. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery.

Forgives some taxpayers of their liabilities even if they have not. If you are filing as Unmarried use Table 1. For example in Pennsylvania a single person who makes less than 6500 per year may qualify to have 100 percent of their state back taxes forgiven.

State Tax Forgiveness. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. These standards vary from state to state.

Cases that have been granted tax exemption will be reviewed every 5 years to determine continued need for exemption from certain real estate property taxes. Cut school property taxes by 644 billion through an increase in the personal income tax from 307 to 462. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP.

Different from and greater than taxable income. Gifts awards and prizes- Include the total amount of nontaxable. To receive tax forgiveness a taxpayer must complete the tax forgiveness schedule and file a PA-40 return.

The homeowner will need to pay each and every monthly or quarterly installment. The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000. Accordingly failing to pay your real property taxes in Pennsylvania could lead to an upset tax sale or a judicial tax sale and the loss of your property.

Hubert Minnis Prime Minister Minister of Finance announced the Governments immediate implementation of the Real Property Tax Forgiveness Program the Program as outlined in The Real Property Tax Amnesty Order 2021 the Order and which came into effect on 1. Pennsylvania is ranked number sixteen out of the fifty. Jan 25 2021 0110 PM EST.

If Line 13 is. States also offer tax forgiveness based on personal income standards. This can be done in the form of tax credits or exemptions.

In case you are a senior citizen living in Pennsylvania you should know that you may be eligible for a rebate on your property taxes or rent. Counties in Pennsylvania collect an average of 135 of a propertys assesed fair market value as property tax per year. A dependent is defined to be a child who can be claimed as a dependent for federal income tax purposes.

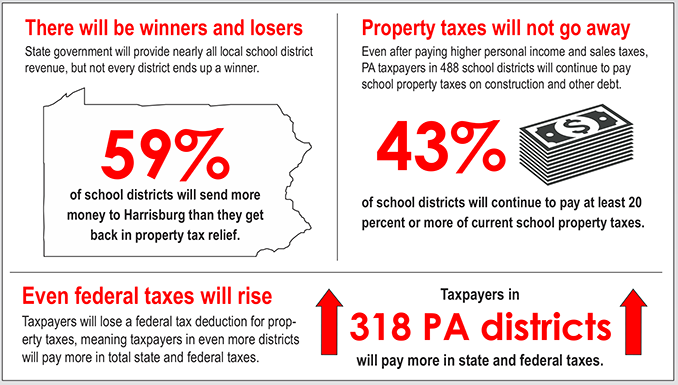

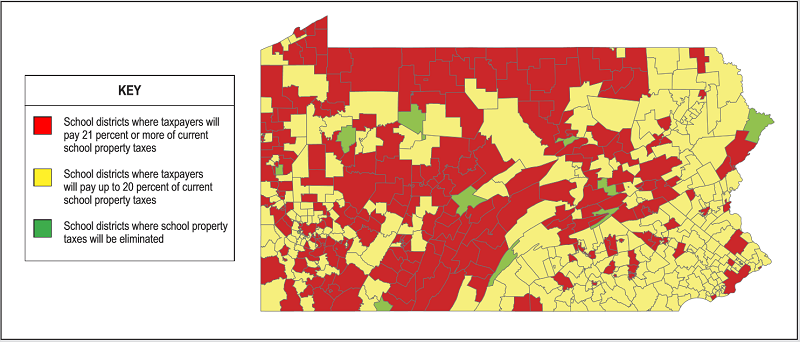

Tax amount varies by county. Heres what you need to know about the Property TaxRent Rebate Program in Pennsylvania Pennsylvania News readingeagle What is the Homestead Exemption in Real Estate Millionacres Property Tax Rent Rebate Form Pa Detroit property tax assessments to decline as 62 What would no property taxes in Pa. Record the your PA tax liability from Line 12 of your PA-40.

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability.

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Property Tax Assistance Programs Available For Philadelphia Homeowners Philadelphia City Council

Property Tax Rebate Program For 21 22 Perkiomen Valley School District

Property Tax Homestead Exemptions Itep

Property Tax Bill Will Cost Pa Taxpayers More

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

Property Taxes By State In 2022 A Complete Rundown

Property Tax Bill Will Cost Pa Taxpayers More

Casino Pennsylvania Proposal Would Aim State S Expanded Gaming Intake Towards Property Tax Relief Gambling Sites Hollywood Casino Online Gambling

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

.jpg)

Pa State Rep Property Taxes Time To Eliminate

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

What Is A Homestead Exemption And How Does It Work Lendingtree

Deducting Property Taxes H R Block

Property Tax Appeals When How Why To Submit Plus A Sample Letter

The Best States For An Early Retirement Early Retirement Life Insurance Facts Life Insurance For Seniors